Self-employed? here's how schedule-c taxes work — pinewood consulting, llc Self employed tax refund calculator Calculate net earnings from self employment

Qualified Business Income Deduction and the Self-Employed - The CPA Journal

Employment calculate

Self employment tax abroad citizens employed

Small business guide to taxes 03032010Self employed tax refund return example worksheets printable canadian money worksheeto government states united via How much self-employed income can you make without paying taxes? leiaTax penalties for high income earners: net investment income, amt, medicare.

Tax income high employment self investment amt earners medicare penaltiesEmployment calculate breakdown business Self employment tax return incomeTax return with self employment income.

Completing form 1040

What is self-employment tax?Self-employment tax 2024 Self-employment tax forms & facs codingSelf employment calculate tax taxes calculating expenses difference huge why business make.

[solved] . filing of annual income tax return for purely self-employedWhat is self-employment tax and schedule se? — stride blog What is self-employment tax? beginner's guideUk self-employed tax calculator 24-25.

Qualified business income deduction and the self-employed

Self-employment tax forms & facs codingQualified business income deduction and the self-employed Usa 1040 self-employed form templateSelf employment tax return form long.

Self employed 1040 income editable1040 tax irs expat completing federal paid explained How to file self-employed taxes in canadaSelf employment income taxes.

What is the fica tax and how does it work?

Self employment tax return 20232024 self employment tax form 1099 employed ppp highlightedTax self employment rate liability calculate business earnings much annual.

12 best images of canadian money printable worksheetsSchedule c tax form llc How to calculate self-employment taxSelf-employment tax.

Self-employment tax for u.s. citizens abroad

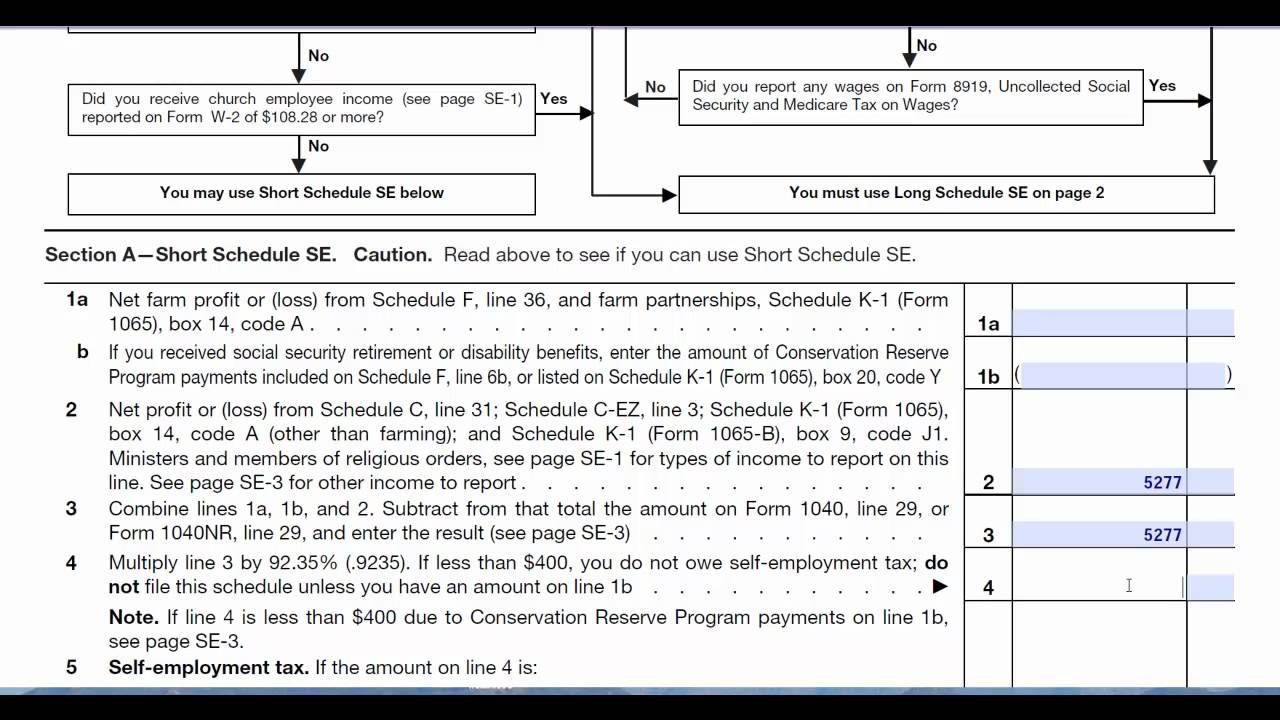

Calculate self employment tax deductionChanges to ppp Tax self 1040 form schedule employment se return spreadsheet sample es excel templates csf bookkeeping example sheets worksheet template formsSchedule se self-employment (form 1040) tax return preparation.

Taxes employment partnership proprietor .